Private Placement Processing

Greenhill Equity Solutions Ltd.'s (GES) principals have extensive experience with the administration and software development related to the efficient processing of private placement subscriptions.

Historically

Before GES, a new subscriber in a private placement would be sent a memorandum and subscription agreement by email or courier. The subscriber completed their information in hand writing and the subscription was mailed, emailed or returned by fax to the company. The information received was often incomplete, a poor-quality scan or an unreadable fax.

This required significant time and correspondence to confirm the correct subscriber information and accredited investor details. The information received was then typed into various internal databases and documents, leading to more potential errors. The subscriber’s, sometimes incorrect, information was then copied and pasted multiple times. Errors identified much later, including incorrect share registrations, often required complicated corrections long after the placement was formally closed.

Once investor payments were manually verified with the bank, the closing documents were circulated for execution at a board meeting or emailed out and signed by each of the client’s board members, scanned and eventually returned for a formal closing of the offering.

Today

With the GES Quantum System, a subscriber receives, by email, a cover letter including the private placement documents and login details for access to a GES web-form. The investor types in all required information and clicks the submit button. Their ongoing choices determine exact questions served up later in the form.

Once submitted and reviewed, the subscriber’s information populates all the required internal documents and creates final agreements for the investor’s digital e-signature. Physical paperwork, ink signatures, mailing, faxing and couriering is eliminated.

The routine execution of all subscriber forms and internal documentation is automated and legally executed by utilizing sophisticated digital electronic signature systems (e-signatures). This allows private placement subscribers to legally execute a subscription agreement from wherever they are, on computers and handheld devices without ever putting pen to paper. Trusted, legally valid, and enforceable around the world, the e-signature system meets stringent security requirements.

Subscribers are updated automatically at each milestone for their individual subscription including confirmation of their submission, payment details, company acceptance and more.

Funds received by the client’s bank or lawyer’s trust account are applied to the subscriber’s placement file. In many cases this application of funds can be automated as well. The data received then automatically populates all paperwork including agreements, spreadsheets, draft letters, draft legal opinions, management reports, draft treasury orders, corporate resolutions and updates any internal client retention management (CRM) systems.

On final closing, a draft treasury order and all required closing documents are automatically created and sent to the client’s lawyer for review. The treasury order and instruction letter are sent to the transfer agent or the shares are created and posted in a GES virtual Corporate Information Management (CIM) system. The CIM contains all necessary information for a company’s lawyer to update the corporate minute book.

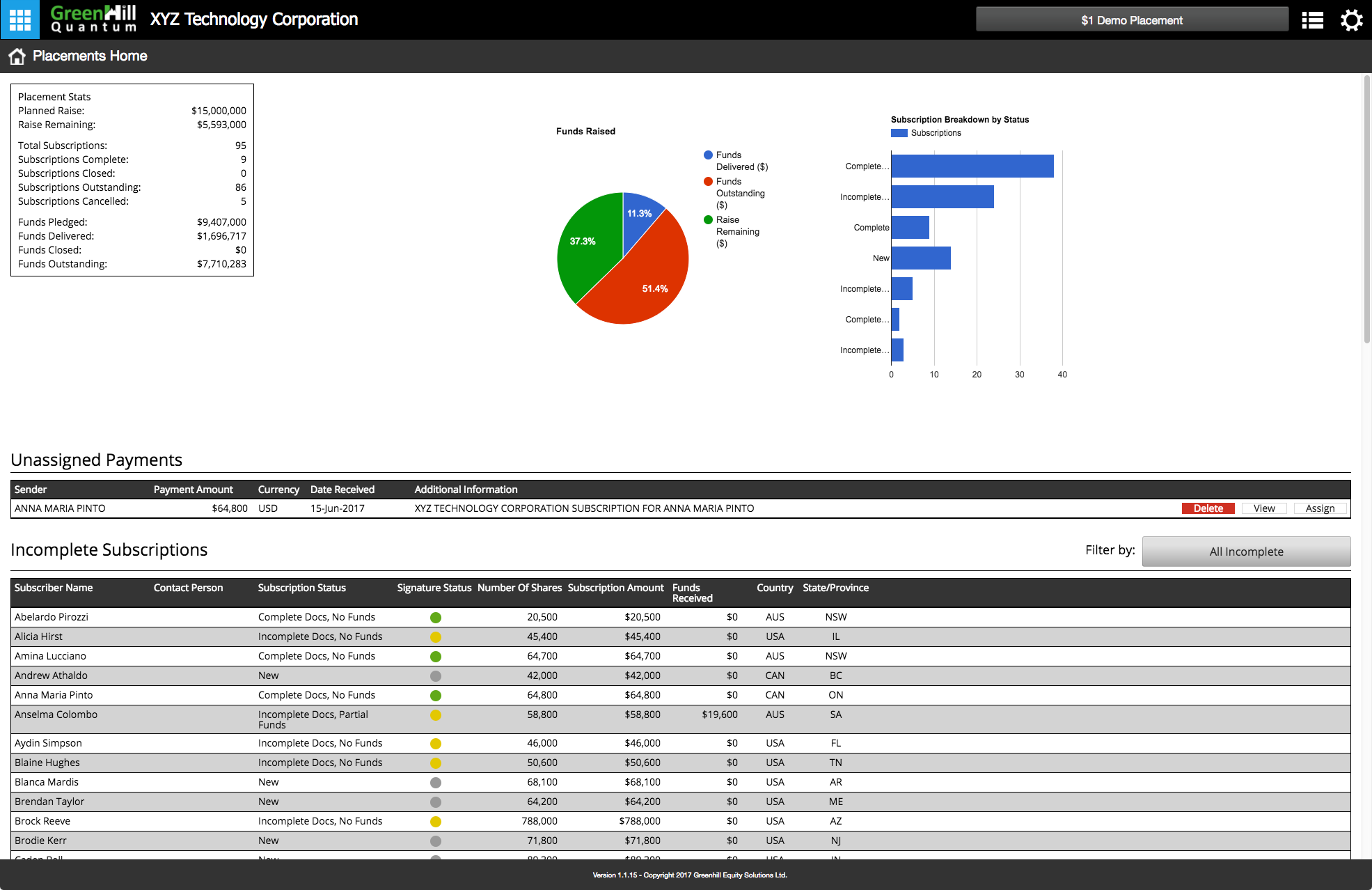

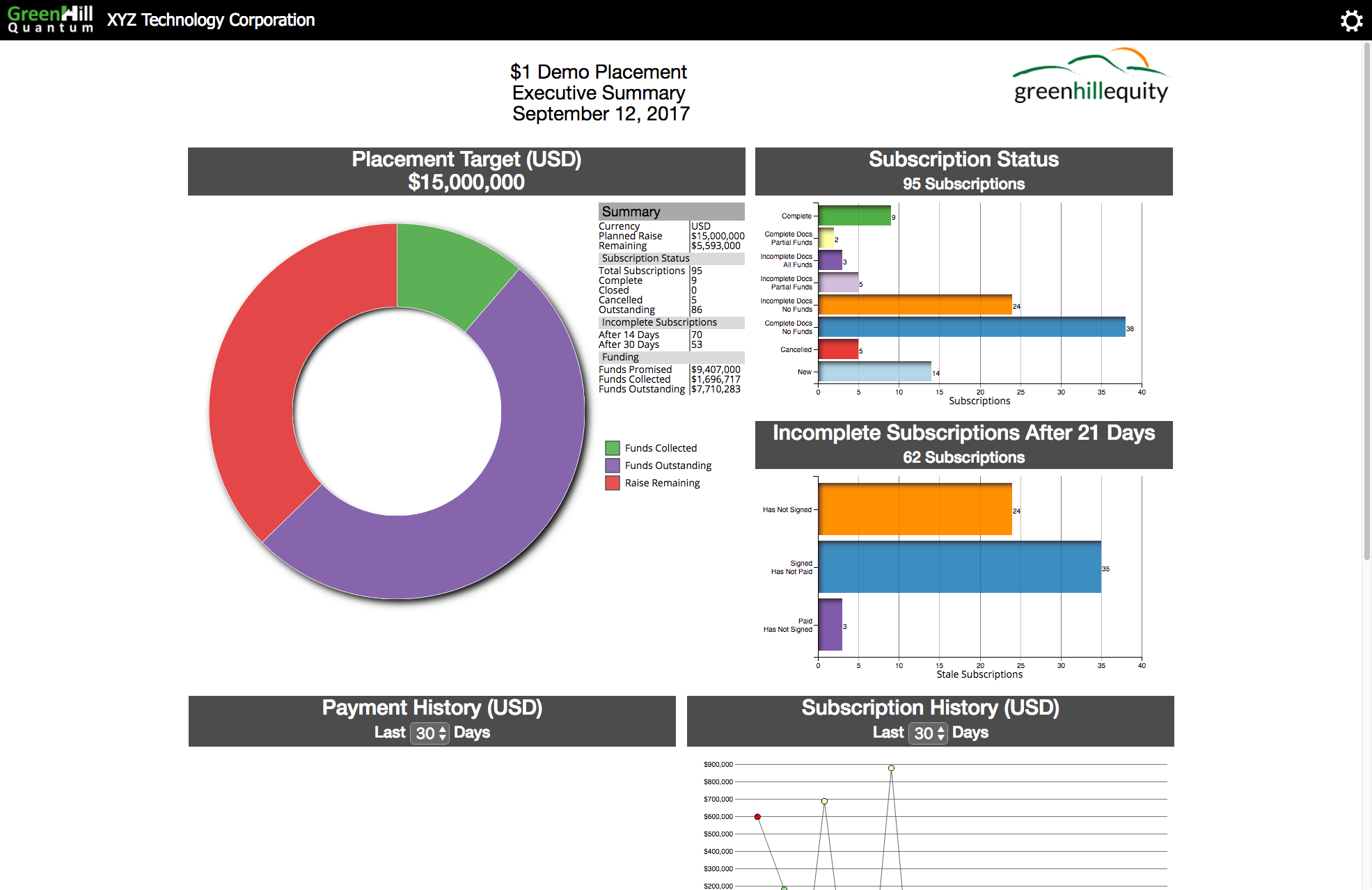

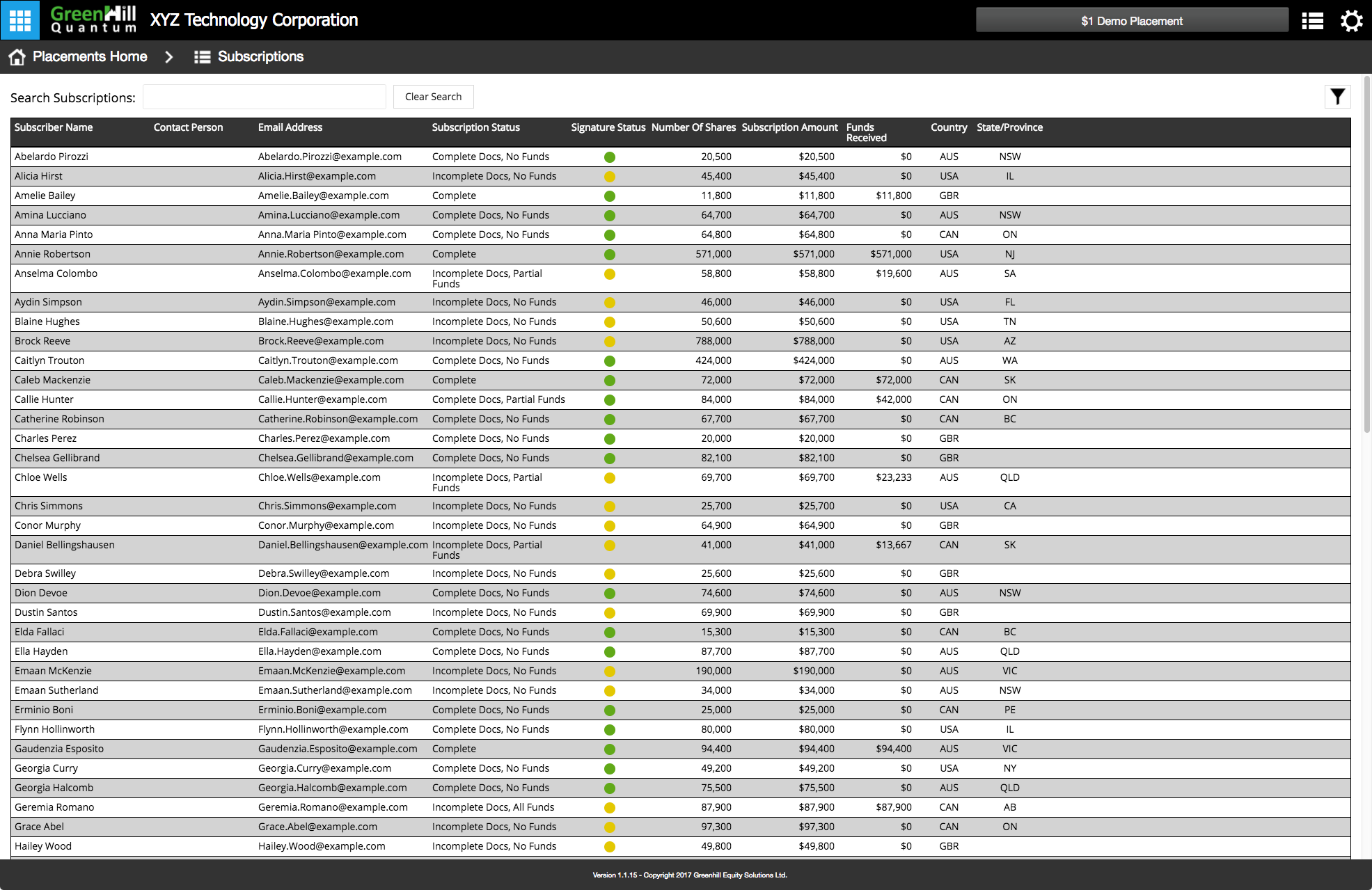

Dashboards

To monitor a placement’s progress during the subscription process, key directors, administration and legal people will have secure access to various real-time, customized GES dashboards. Access to these dashboards is protected by layers of authentication to ID an authorized user.

These dashboards display a summary of the progress of an individual placement and generate separate alerts for each subscription as they are submitted. This negates the preparation of numerous updates, that are typically required by management regarding a placement’s status. Any additional, specific custom data reports required by participants are made available.